Most people like to ask, what stocks are able to give a high return in short period?

As an investor, I can’t answer you on this but I can tell you what type of company you should focus on - company that acquired another profit making business.

Acquisition is a corporate action in which a company buys most or all of the target company's ownership stakes in order to assume control of the target firm. Acquisitions are often made as part of a company's growth strategy whereby it is more beneficial to take over an existing firm's operations. Acquisitions are often paid in cash, the acquiring company's stock or a combination of both.

What is the effect of business acquistion to a company? How powerful is an acquisition?

I would like to share about two examples.

Inari Amertron Berhad was formed following the merger and acquisition of two EMS providers: Inari Berhad and Amertron Limited.

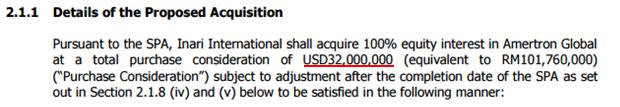

The following is the annual result for Amertron Group before acquired by Inari. Based on three year average, Amertron was able to achieve USD4m profit after tax, which is equivalent to MYR12.7m (USDMYR = 1 : 3.18) during that time.

That’s mean if Inari successfully acquire 100% of Amertron, they will take all its net profit into account in the next financial year! With an additional of MYR12m+ a year, definitely Inari financial result will fly! Let’s have a look at Inari financial result before and after acquistion.

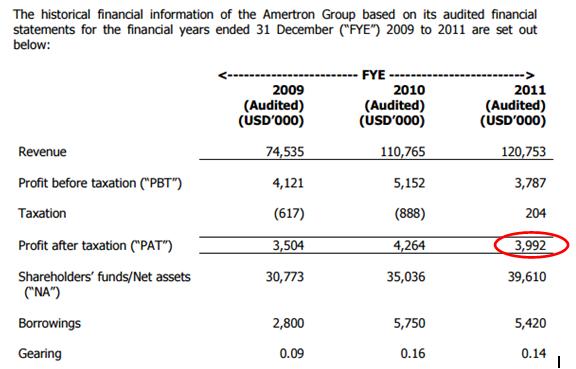

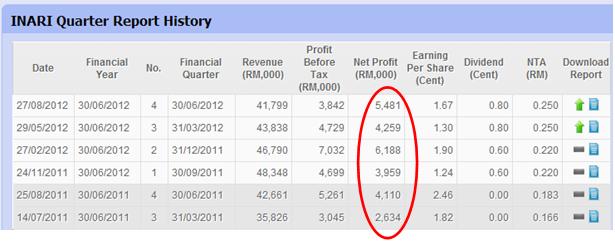

Before

After

Basically, Inari net profit had increased 400% in addition with the robust of the industry!

Furthermore, don’t forget the acquisition is only costs USD32m! With only USD32m, Inari can make extra USD4m a year! The PE ratio for this acquisition was only 8!

The below is the price chart of Inari. Its price went from MYR0.40 to MYR3.30 today, 700+% increase over the 3 years! This is crazy.

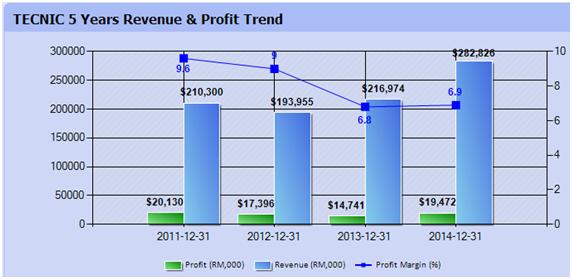

Another example is SKP Resources (“SKPRES”). On 2014, SKP acquired whole three subsidiaries under Tecnic Group Berhad.

The cost of this acquisition was MYR200m!

TECNIC net profit on FY14 was MYR19.5m, that’s mean SKPRES will have additional MYR19.5m net profit taken into its financial result after acquisition! The PE for this acquisition is 10.20, still acceptable.

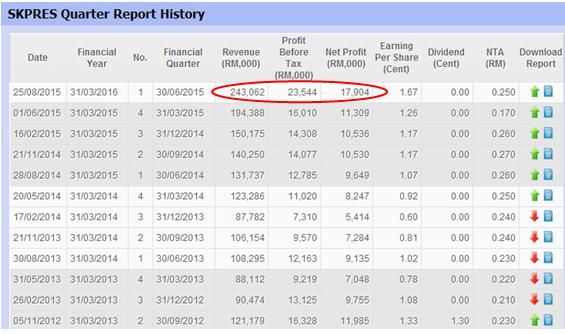

The net profit of TECNIC was only taken into account on FY15. As above, SKPRES’s revenue and net profit had increased significantly.

Have a look with SKPRES price chart as well. After the acquisition, its price moved up from MYR0.70 to current MYR1.40, equivalent to 100% gain in less than a year!

From the two examples above, it proved that acquisition of certain profit making company will lead the company to a new milestone. In term of its price and financial result, both also will go to a new high level. Definitely, this is the company that we need to focus on and catch.

All you need to do is to carry out some simple homework by reading its circular. If you willing to spend some time to understand some important details, with this small effort and knowledge, you might easily earn up to 2-3x return!

So, what will be the next potential company that probably carries out the same things? Which will be the next Inari and SKPRES?

This? The rest I will leave it for you to study.

Just for sharing.

No comments:

Post a Comment