There are many approaches that we can use to select a stock. NCAV is one of it.

Net current assets value (“NCAV”) is calculated by taking a company's current assets and subtracting the total liabilities, and then dividing the result by the total number of shares outstanding.

According to Graham, investors will benefit greatly if they invest in companies where the stock prices are no more than 67% of their NCAV per share. He also mentioned that any companies selling below their NCAV values carry lower risk: “They are worth considerably more than they are selling for, and there is a reasonably good chance that this greater worth will sooner or later reflect itself in the market price. At their low price these bargain stocks actually enjoy a high degree of safety, meaning by safety a relatively small risk of principal.”

FACB Industries Incorporated Berhad is one of the examples.

- Wholesales dealership and retailing of mattresses, furniture and related accessories

- Manufacturing and sale of stainless steel butt-weld fittings

Current price = MYR0.965

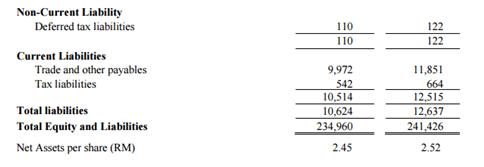

Net tangible assets (“NTA”) = MYR2.45

Net current assets value (“NCAV”) = MYR2.06

FACB current price is only 46.8% of its NCAV now. The main current asset of FACB is its MYR150m cash on hand with zero borrowing/debt!

After the bullish trend on end of 2012 due to disposal of loss making subsidiary at China, FACB breakout from the level of MYR0.60 and moved in the price range of MYR1.00-1.60. The highest it reached before was MYR1.65. However, now it back to the level of below MYR1.00.

Malaysia famous investor, Cold Eye (冷眼) had mentioned about this company in his book too. He also related it to cash rich, high NTA and NCAV. If I am not mistaken, he holds FACB since few years ago until now. However, based on the chart, if you bought in at the beginning of 2013 and hold until now, you will face losses in term of price appreciation. In other words, you wasted three years of your time by getting nothing.

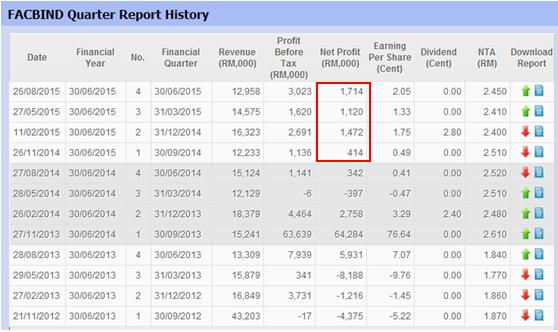

In term of its financial results, FACB’s net profit started to be stable since second quarter of FY15.

The below is the statement which I extracted out from its latest financial report.

“The bedding operations in Malaysia recorded better profit before tax mainly due to improved gross profit margin despite a 20% reduction in revenue. The stainless steel fitting operation posted a reduced loss before tax due to improvement in selling price and gross profit margin. Higher profit contribution was recorded by associates in the business of power generation.”

I had not much comment on that. However, if you compared its net profit with its assets, you will found that its Return on Asset (“ROA”) is only 2% for the whole FY15! FACB is a very cash rich company since the disposal of subsidiary since end of 2013. It had been almost 2 years and yet its management doesn’t make use of their cash wisely, either to expand the company business or acquisition of other potential company. FYI, FACB is a beneficiary of weakening of MYR. It is not affected by low commodity or crude oil price too.

Even though FACB had MYR150m cash on hand, they also did not declare any special dividend after the disposal. The dividend they declared is one year lesser than one year. They rather keep the cash in their bank.

| Financial Year Ended | Dividend per share (cent) |

| FY2015 | 2.50 |

| FY2014 | 2.80 |

| FY2013 | 3.20 |

Most investors tend to say that by using MYR1+ per share, they can purchase a company with NCAV up to MYR2+ per share. But for me, no matter how rich a company is, as long as they do not use its cash to generate more profit or unlock its value, it is still meaningless. In every comprehensive income, there is a “profit attributable to owners of the company”. It is the part which belongs to investors. It also reflects the quality of management and how well they maximize the value of shareholders.

For example, what will you do if you have MYR150m cash on hand? Some will invest in shares market, some will establish a new business, and some will buy a new property. There are many ways to use this cash wisely in order to grow your money. However, if you do nothing and save it in bank, you will only get bank interest by the end of every year. It is true that you will not have any risk but at the same time the return you get will be very low.

With no doubt, in term of financial, FACB is very health. However, in term of profitability, it is not. I agree that the risk of investing in FACB is much lower compared to others because of its high NCAV, as it definitely able to survive through financial crisis if any, with this huge amount of cash. But, if you aim for higher return, FACB is surely not suitable for you.

As a conclusion, there is no right or wrong in every approaches. Before I end this, for those who mainly use NCAV approach for stock selection, here is a list of stocks for your reference.

| STOCKS | NCAV |

| KESM | 2.80 |

| Magni | 1.37 |

| SHL | 1.35 |

| Lii Hen | 1.28 |

| UPA | 1.26 |

| ECS | 1.22 |

| Ulicorp | 1.05 |

| Latitude | 0.95 |

| Oriental Food | 0.95 |

| Favco | 0.93 |

| Focus Lumber | 0.89 |

| Y.S.P Southeast Asia | 0.88 |

| Fututech | 0.83 |

| IQ Group | 0.82 |

| Matrix | 0.79 |

| SCC | 0.66 |

| Mitrajaya | 0.63 |

| Vitrox | 0.58 |

| KKB | 0.53 |

| HSL | 0.52 |

| SCGM | 0.52 |

| Turbo | 0.51 |

| Sycal | 0.49 |

| LTKM | 0.39 |

| Classic Scenic | 0.38 |

| Signature | 0.37 |

| Willowglen | 0.35 |

| Prolexus | 0.35 |

| LCTH | 0.30 |

| Superlon | 0.29 |

| CCM Duopharma | 0.28 |

| Uchitec | 0.28 |

| Homeritz | 0.22 |

| SLP Resources | 0.19 |

| Tambun | 0.18 |

| Wellcall | 0.16 |

| Scicom | 0.16 |

| Ken | 0.13 |

| SKP Resources | 0.13 |

| Penta | 0.13 |

| Elsoft | 0.12 |

| Hup Seng | 0.11 |

| Boilermech | 0.11 |

| Excel Force MSC | 0.08 |

| Mikro MSC | 0.07 |

Just for sharing.

No comments:

Post a Comment