Indeed, the market itself is not a rational place. It might not have a reason behind why it suddenly moves up and why it suddenly moves down. As an investor, the only things we can do are to look through the whole picture and pick stocks based on its catalyst, fundamental.

However, no matter how bad the fundamental of a company is, as long as it had little bit related to current theme played by speculator, eventually it will still “digoreng” up.

One of the examples was VSOLAR. It went from MYR0.15 to MYR0.35 in two months time, which is equivalent to 133% return. The highest it reached before was MYR0.45.

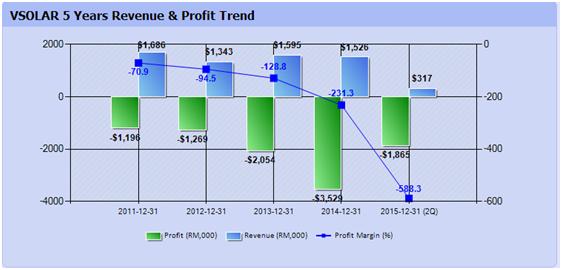

Obviously, the uptrend is not supported by its revenue and profit or any improvement. VSOLAR is a loss making company which it had made losses for more than 32 quarters continuously!

So, what is the reason behind the VSOLAR bull trend from Dec 14 to Mar 15?

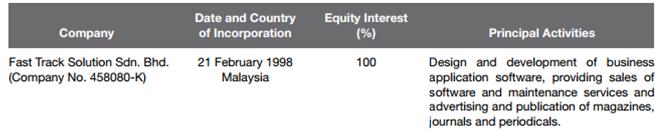

VSOLAR is principally an investment holding company as well as renewable energy, media publishing, software solutions and production house.

If I am not mistaken, speculators related the theme of “Solar” and “GST software” with VSOLAR during beginning of the year 2015. They took this opportunity to lift up VSOLAR. When the price is going up without the support of its revenue and profit, it is just like a timing bomb and the speculators are holding the bomb and passing to each other. When the bomb times up, it is time to say goodbye to the unlucky one. The market maker took profit and disposed all their VSOLAR shares when they had satisfied with the amount. VSOLAR dropped from MYR0.35 and back to its original value. Now, it is only MYR0.085 which is lower than its previous price before it “digoreng” up.

The saddest thing is I still saw some people commented that they had averaged down by collecting more. I can’t imagine how their investment on VSOLAR is right now. Indeed, it is nothing difference with gambling!

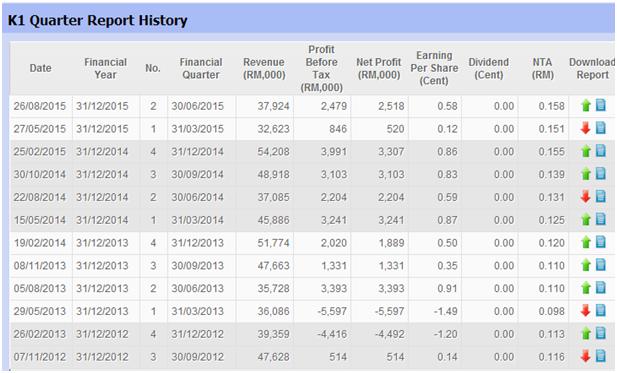

Another example is K1. Since the crude oil crisis on Dec 2014, K1 started to move up again from the price of MYR0.35. It took 5 months to reach MYR0.65, which is equivalent to 86% return.

Based on its quarter report before FY15, it is profit making company with consistent earning. So, it is reasonable why its price moves up slowly.

However, after FY15Q1 report out, K1’s earnings dropped more than 70%! Subsequently, the next two day, it dropped to MYR0.305. It only took 2 days to drop 51%! Even until now, K1 are still not coming back yet. I believe one of the reasons is fear and it caused most investor no longer interest in K1.

If based on K1 fundamental, I am very sure theoretically this should not be happen, at least it is still profit making. But, this is shares market. I believe there are some market makers behind this. Coincidently, K1 quarter earnings dropped significantly. So, they took this chance to dispose everything and it caused fear among the investors. Of course, this is just my thought, I might be wrong too.

However, if you are an investor and had some knowledge in shares, you might not fall into this.

1st support line was set when the price breakout. The support had been shifted up to 2nd line once it breakout to a new region. Subsequently, we moved the support to 3rd line followed by another breakout. The concept is very simple, once the price retested the support line few times and eventually dropped below the support line, it means that it is time for us to take profit. Besides that, the shooting had been formed at the top. So, it is also another signal that the trend had started to change.

I believe the reversal of trend most probably caused by insider news. There will be some employees or friends who know the first hand news that K1 quarter earnings drop significantly. So, they disposed of their shares first before the report released.

Let’s say even though you fail to sell it before the report released. But, at least you will still sell it once you saw the report because it’s a change in K1 fundamental.

In addition, it is a very long bear engulfing candlestick. At least, you will not trying to average down by collecting again. So, this is why I am trying to emphasize that investment knowledge is important!

This is one of the case study which I tried to bring out the message of importance of knowledge. After every fail investment, we need to sort out what the reason is and what’s wrong with our strategy. Learn from every mistake. I believe it will help us to improve and gain more experience.

As a conclusion, in order to success in shares investment, we should acquire ourselves with knowledge. Always remember that 80% of people lose money and only 20% win money in shares market. So, which one you want to be? A speculator or an investor? Start from today, invest in yourself rather than continue paying fees to the market. The best investment you can make is in yourself.

Just for sharing.

I am a serious marketer and I want to make it big. 5 Years down the line, I want to groom myself into one of the biggest guys in digital marketing a.k.a. 'The Wolf'. I restlessly 'çrawl' the web for intelligent marketing blogs and consume knowledge liberally. See more sample marketing case study analysis

ReplyDelete