It may seem like you should do your homework before putting all your cash in a company's stock, but in fact many people don't. With that in mind, here are some questions investors should ask -- and answer -- before buying a stock.

Of course, knowing all the answers doesn't guarantee a winning stock. Nothing can do that. But over the long haul, taking the time to consider these questions will make one a better, more well-informed investor.

I will carry out an illustration by using ECS ICT Berhad as example.

1. What Does the Company Do?

Before invest in a company, we need to know what is the business about. As a shareholder, I think we had the obligation to understand the business nature.

ECS was principally involved in

- Distribution of ICT products

- Enterprise systems

- Provision of ICT services.

ECS business activities lie predominantly in the distribution of ICT products and enterprise systems. They purchase ICT hardware and software from multiple international leading ICT principals such as HP, Cisco and Microsoft, and distribute them to resellers which typically comprises of system integrators, corporate dealers and retailers. Some examples of common products includes servers, PCs, notebooks, printers, scanners, wireless products, LCD monitors, operating systems, system management tools and ICT security products.

2. Is The Business Sustainable in Future?

We definitely need to make sure it is not sunset business. It must be sustainable in future. For example, if the company business is related to films and frame, I surely will not invest in it.

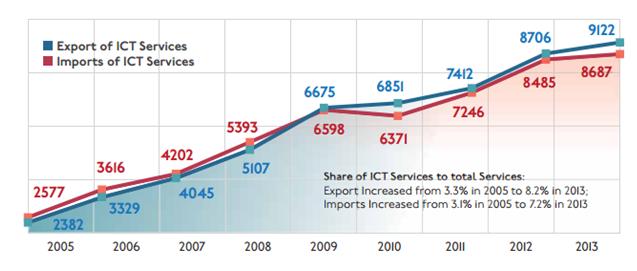

Exports and Imports of Telecommunication, Computer and Information Services in Malaysia

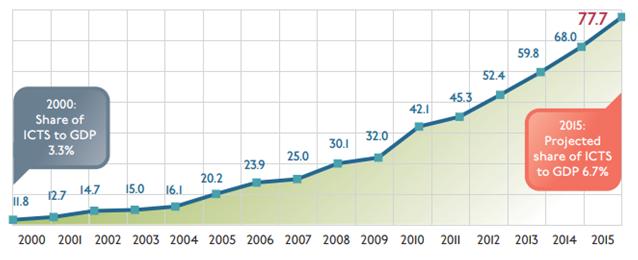

Distribution and Growth Rates of ICT Services by Sub-sectors in Malaysia: 2000-2015

As we can see on the above, ICT industry is growing rapidly in the past 10 year. The continuous advancement of technology brings about frequent hardware and software improvements as well as the introduction of new technologies. So, ICT industry is expected to continue expand and grow in the next few years, either with fast pace or slow pace. The number of international ICT brands in Malaysia market will also grow in line.

3. Is the Company Profitable?

Investors can read the quarterly and annual earnings reports to check out how much net income the company reported and in per-share earnings.

REVENUE RM'000

| |||||

FY/Quarter

|

2011

|

2012

|

2013

|

2014

|

2015

|

1

|

278,902

|

305,387

|

320,335

|

357,719

|

522,855

|

2

|

312,149

|

309,259

|

300,463

|

389,916

|

418,790

|

3

|

317,866

|

327,937

|

344,192

|

392,011

| |

4

|

341,770

|

333,537

|

361,276

|

451,471

| |

TOTAL

|

1,250,687

|

1,276,120

|

1,326,266

|

1,591,117

|

941,645

|

| NET PROFIT RM'000 | |||||

FY/Quarter

|

2011

|

2012

|

2013

|

2014

|

2015

|

1

|

7,026

|

8,101

|

6,381

|

4,785

|

9,389

|

2

|

5,606

|

5,615

|

5,498

|

7,515

|

8,001

|

3

|

7,051

|

6,537

|

5,281

|

7,282

| |

4

|

10,460

|

9,611

|

9,728

|

9,850

| |

TOTAL

|

30,143

|

29,864

|

26,888

|

29,432

|

17,390

|

ECS has a history of steady earnings growth. In first two quarter of FY15, its revenue and net profit are greater compared to the past 4 year.

4. How Clean Is the Company's Balance Sheet?

An investors need to be able to read over a company's balance sheet. Is the company saddled with a huge amount of debt compared with how much it earns? Checking out a company's earnings alone doesn't tell you if the company has borrowed to achieve those earnings. However, one doesn’t need to have accounting basic to go through the balance sheet, just make it a simple one.

| Net borrowing, MYR'000 |

-

|

-

|

-

|

-

|

| Cash on hand, MYR'000 |

66,577

|

72,989

|

83,700

|

89,749

|

| Debt ratio |

46.63%

|

43.42%

|

41.34%

|

45.59%

|

ECS has no borrowing at all for the past four years and it has MYR90m cash on hand! It is very healthy in term of financial condition.

5. Who Runs the Company?

This is one of the main things that we need to look into. Management qualities reflect positively on the company's stability. Any company will have a website that lists the management team, how long they have been with the company and their background. Or, it can be found in annual report as well.

It needs to beware when someone takes over the decision maker position, especially from father to son.

| Foo Sen Chin (“Foo”) Executive Chairman Age: 67

|

| Soong Jan Hsung (“Soong”) Executive Director / Chief Executive Officer Age: 51

|

Mr. Foo is the founder of the ECS while Mr. Soong began his career in ECS two years after ECS’s commencement of business. Both of them have 30 and 28 years experience in this field. They contributed significantly to the Group from non listing to listing and maximized shareholders’ wealth by improving ECS revenue and profit. The company performance itself is the best indicator to reflect the management quality.

6. What Are the Company’s Risk Factors and Catalyst in Current Economy?

Implementation of GST

GST was implemented in Malaysia on 1st of April, to replace the zero per cent under the Sales and Service Tax regime. Definitely, there will be an initial slowdown in ICT sector due to the market's reaction to the GST. The expected impact is likely to be an overall slowdown in consumer sentiment and ICT spending, most notably in the consumer retail segment.

Smaller companies, particularly small and medium enterprises, will be more affected by the GST with most delaying their ICT investments for now. I expect ECS second and third quarter performance will be slightly moved down.

Depreciation of MYR

MYR had depreciated 30% since last year until now.

USD1 = MYR3.30 as at 1st September 2014

USD = MYR4.30 as at 10th September 2015

ECS was purchasing its ICT products from its global brands ICT principals, where all of them are from foreign country. That’s mean ECS was purchasing using foreign currency and selling to third party using domestic currency.

As above statement, approximately 33.8% of purchases are priced in USD. Theoretically, strengthen of USD against MYR by 10% will reduce net profit by MYR2.5m! The management just hedge part of its exposure only.

In term of good catalyst, I don’t see any so far besides than its excellent financial result. There is no merger and acquisition or expansion. However, this year is ECS 30th anniversary. There might be a possibility that ECS will declare special dividend or bonus issue!

7. Is The Company Cheap In Term of Price?

A good fundamental company doesn’t mean it is cheap. For example, you saw a very nice NIKE shoes but it costs MYR1k, will you still consider?

As at 11st September 2015,

| Price | : MYR1.42 |

| Outstanding shares | : 180,000,000 |

| Market capitalization | : MYR255.60 million |

| 52 week range | : 1.02 – 1.83 |

| P/E | : 7.43 |

| D/Y | : 4.23% |

| ROE | : 14.58% |

| NTA | : MYR1.31 |

Based on above parameter, ECS’s PE is very low and its D/Y is attractive.

ECS’s FY14 net profit was MYR29.43 million. By using CAGR of 7%, ECS is expected to achieve a net profit of MYR31.49 million on FY15. It is equivalent to 17.5 cent earnings per share. By referring to the table below, obviously it is achievable. With a PE ratio of 10-11, ECS will have a fair value of MYR1.75 – MYR1.93.

| Financial year |

2014

|

2015

|

Q1

|

4,785

|

9,389

|

Q2

|

7,515

|

8,001

|

Q3

|

7,282

| |

Q4

|

9,850

| |

Total

|

29,432

|

17,390

|

It still has 20%+ room to move. So, I think it is still fairly cheap.

By answering the 7 questions above, I believe you will have your answer to decide whether to invest or not. Of course, there is no right or wrong whether to pick or not, as everyone had their own method of investing. Find the company that suits your criteria the most.

Just for sharing.

No comments:

Post a Comment